S.I.B.S. Approach: Evaluating the Merit of a Claim

First Published 3/10/2015, Updated 5/6/2021 The success of properly processing an insurance claim requires due diligence/fiduciary duty as an insurance professional to evaluate each claim

Catastrophe Fraud: Learning from the Past

When natural disasters happen, having all the variables in place to ensure a smooth claims process is key. There are many times when, due to

Keys to a Successful Workers Comp Investigation

Every corporation has a number of internal components that need extra scrutiny, and workers’ compensation fraud is one of these important components. Even as the

How Brumell Group’s Case Analysis™ Helps Close More Cases

Did you know that insurance companies have, in good faith, a fiduciary duty to report fraud to the state if they suspect fraud is being

How to Identify Malingering

In the world of insurance claims, medical assessments, and disability cases, malingering is a very important factor to consider. Being able to identify malingering is

Why Use an External Resource for an Internal Investigation?

There are many instances within a corporate entity where allegations of fraud, misconduct and other crimes must be investigated. In order to keep the investigation

What is Catastrophe Fraud?

Catastrophe fraud occurs when there has been a natural or man-made disaster when insurance companies are taken advantage of.

Skipping Pre-Employment Background Checks (Due Diligence) Could Cost Your Company

There is a rise of “negligent hiring” lawsuits in the U.S. The courts are finding that companies, even small businesses, have “duty of care” responsibility

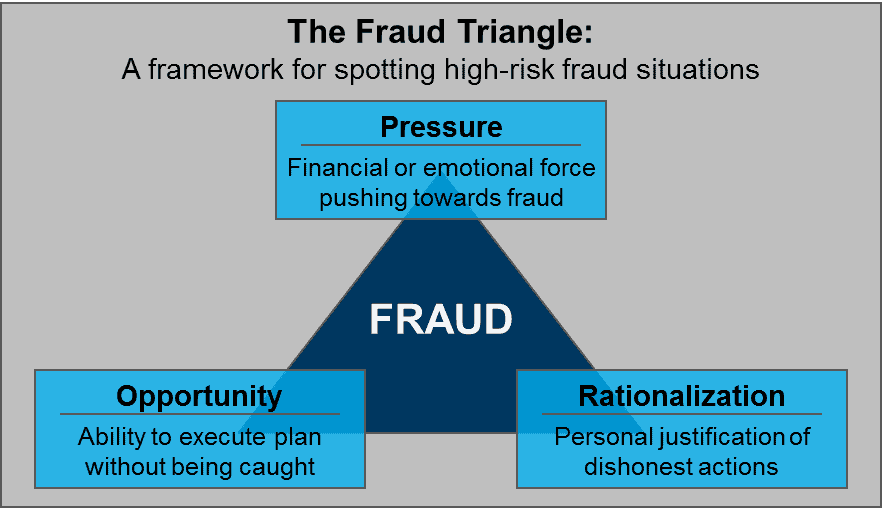

The Fraud Triangle Theory

Fraud is a crime that is more costly than most people realize. According to the FBI, non-healthcare related fraud alone is estimated to cost the

The Self Administered Interview

Investigators face a serious challenge when an incident occurs: eyewitness memory recollection. There could be numerous eyewitnesses, any of which may hold potentially vital information